INVESTMENT MANAGEMENT

We work with clients who can invest more than $250,000 in aggregate and can establish accounts with a sub-minimum of $10,000 per registration / account type.

We embrace that your financial goals and needs are diverse and unique, so we provide tailored advice and portfolios for your time horizon, risk tolerance, tax scenario and investment objectives. Portfolio construction is contextualized from an account level through to a household level. A tax-deferred retirement account would be managed and constructed differently than a taxable account.

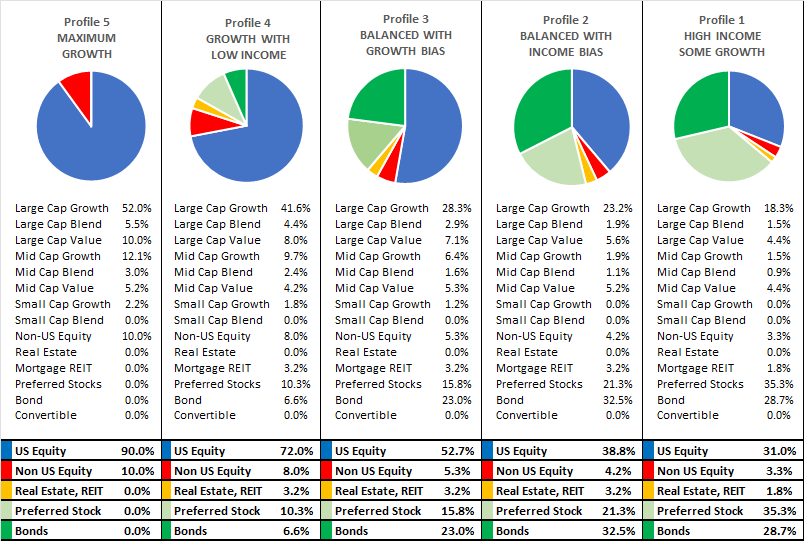

After evaluating your needs, we can help you design portfolios that follow these attributes:

Our due diligence process is centered around locating the most effective fund managers, public companies, asset classes or sectors that we believe will contribute to out-performance in all market cycles.

We employ several portfolio management theories, the most notable are:

- Modern Portfolio Theory - a quantitative/mathematical based approach to determine optimal risk-reward paradigms in asset allocation design.

- Behavioral Finance - a qualitative approach that includes reviewing shifting trends in consumer spending to anticipate the future including emotional attributes such as fear and greed which create inefficiencies, opportunities and threats.

- Active Management - We attempt to provide alpha (positive risk-reward metrics) through sector selection, individual security selection and active trading.

STOCKS: DIGITAL TRANSFORMATION & ARTIFICIAL INTELLIGENCE is providing unprecedented disruption and investment opportunities not seen since the industrial revolution and our goal is to capitalize on this theme within our equity sleeves. DEGLOBALIZATION: The Ukraine/Russian war has split the economic world into two parts, creating both disruptions, risks and opportunities. We believe that issues such as these create fertile ground for active management, the application of human judgement on sectors, businesses, and asset classes.

DEBT/INCOME: CD's, US government and investment grade bonds are paying the highest yields in over a decade. They offer compelling alternatives to stocks by providing income and can mitigate portfolio volatility usually associated with equities. The Federal Reserve's public commitment to see positive real rates across the entire yield curve (Powell press conference 9/21/2022), means elevated cost of debt which is likely to be a headwind for businesses that traditionally use debt such as real estate.

We are excited when our clients task us with making distinctive judgements for their growth and income sleeves.

OUR PORTFOLIO MANAGEMENT SERVICES: Needs analysis, customized portfolio design, research, execution, monitoring, rebalancing, tax harvesting, required minimum distribution calculation, liaising with your tax professional with respect to IRA/ROTH contribution consulting and execution. Also, provision of tax documents, and liaising with your estate attorney with respect to trust related matters and income distribution planning.

Investing can become overwhelming and complex but, if handled properly, will be paramount in crafting your financial future. Whether you are in the wealth accumulation, income distribution stage of life, let us help you design and manage a portfolio that is uniquely suited to your needs.

YOU MIGHT ALSO BE INTERESTED IN:

- Managed Accounts

- Modern Portfolio Theory and Behavioral Finance

- Aggregation & Performance Reporting

- Retirement Planning